The Globalization of Venture Capital (Your Ideas Needed!)

VC firms are increasingly investing in foreign startups. Why? It's still a puzzle. Help me crowdsource an explanation so I can keep researching this topic!

In an earlier edition of this newsletter, I told you about one of my papers on the effect of immigrant entrepreneurs on cross-border venture capital (VC). Since then, my coauthor Sarath and I received the exciting news that the paper was accepted for publication in the Strategic Management Journal (one of the top academic management outlets). Yay! This time around, I want to tell you more about the globalization of VC in general and provide some cool facts we learned while doing the background research for the paper.

I also have a selfish motive: I’m hoping to crowdsource your ideas on what might be explaining why some VC firms invest abroad more than others, and why they differ so much in their preferred locations. But for that to make sense, I first need to provide the facts. Stay tuned, though, because I’ll be asking for your input at the end.

Cross-border VC is puzzling

I’ve become somewhat obsessed by this topic for several reasons. VC firms from all over the world are increasingly investing in startups located outside of their HQ or primary geographic market. While domestic VC is still dominant, the record amount of cross-border VC is somewhat surprising. Historically, the VC industry has been strongly local: research shows that the odds of making a VC investment and the success of that investment are strongly predicted by geographic proximity (Bernstein et al., 2016; Chen et al., 2010; Cumming & Dai, 2010; Gompers & Lerner, 1999). This colocation is driven by a few related considerations. Investing in startups is extremely risky and uncertain; the market is plagued by issues of information asymmetry. It’s hard to gather reliable information to discover the existence of a startup, determine its quality, decide on the right valuation, and monitor its performance after investing. To mitigate these information problems, investors rely heavily on social and professional networks to obtain reliable, exclusive information to access potential deals (Hochberg et al., 2010; Powell et al., 2005). These networks are composed of other investors, current and former entrepreneurs, and other members of the business community. Critically, those networks are local and tightly guarded to foster trust, commitment, and reciprocity (Sorenson & Stuart, 2001, 2008). The point is this: it’s kind of ironic that the industry funding the most cutting edge startups functions in a very old-fashioned way, through personal relationships and referrals.

Once you know that, cross-border investments by VC firms are surprising because they seem to go against the grain of all those benefits of localization. VC firms appear to be violating the proximity rule. By crossing-borders they are taking on the additional risks and uncertainties of dealing with cultural, legal, institutional, and other differences across countries. From a strategic and organizational standpoint, it’s not clear what the optimal approach to global markets should be. Should a VC firm adopt similar processes and criteria for key activities like fundraising, finding and screening potential investments, offering post-investment support, etc.? Should the firm establish a local office in key markets or control operations from HQ? Is it wise for VC firms to syndicate investments in foreign startups by co-investing with a local VC partner, or does a local VC partner not matter to the fate of the focal VC’s investments abroad? These questions are somewhat unprecedented for the industry, but crucial for the success of cross-border VC and for the health of the global startup ecosystem.

(Digression: My former students might recognize that these questions can be addressed with the frameworks we discuss in class. CAGE, anyone? BBB, anyone? AAA, anyone? OK, digression over. Apologies to readers who aren’t former students.)

Interesting facts about cross-border VC by U.S.-based firms

I’m not going to answer those questions here. Instead, I simply want to provide some basic facts to document the growth of cross-border VC. Data on this phenomenon is not easy to come by. I’ll report some trends based on the international investments of the top 100 U.S.-based VC firms. The data come from VentureXpert, a proprietary database owned by Thomson.

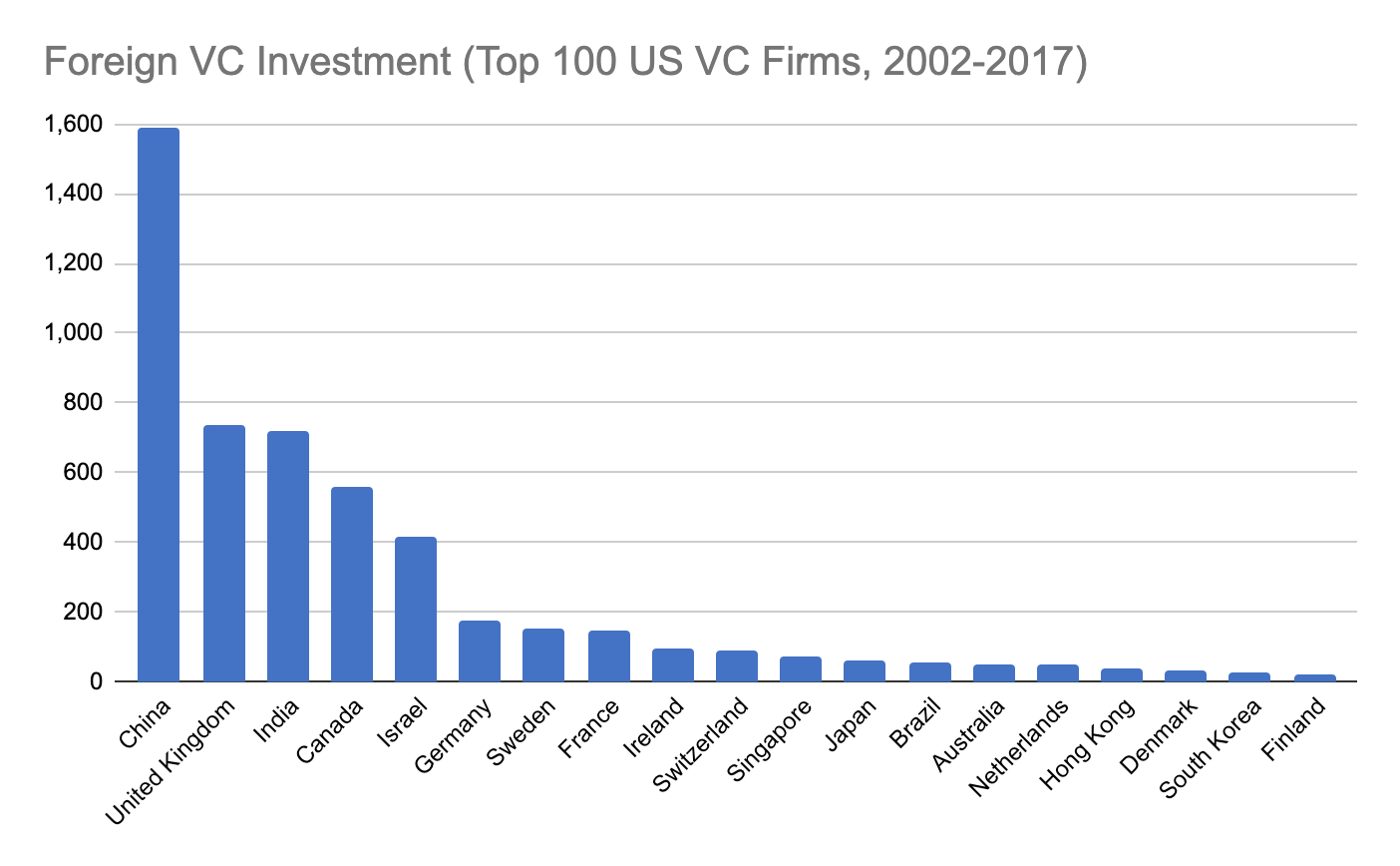

A lot of cross-border VC is happening. We found that the largest U.S. VC firms invested in 5,318 distinct startups located outside the U.S. during 2002-2017. For comparison, the same firms invested in 45,301 U.S.-based startups. It’s clear that domestic (local) investments remain the norm, but it’s also not trivial that roughly 10% of these firms’ investments are outside their home countries. The figure below shows the most common foreign destinations. China is by far the largest, accounting for 1,589 total unique startups. The U.K. and India are nearly tied for second place, with 736 and 722 unique startups, respectively. Canada comes in fourth place, with 557 startups, followed by Israel in fifth place with 415 startups. After the top 5, the remaining individual countries each account for significantly fewer investments. However, the Western European countries in the chart add up to 761 unique startups. That puts the region in the same order of magnitude as the U.K. and India. The missing regions are noteworthy: Latin America (other than 54 investments in Brazil), Africa, and the Middle East receive very little investment from VC firms based in the U.S.

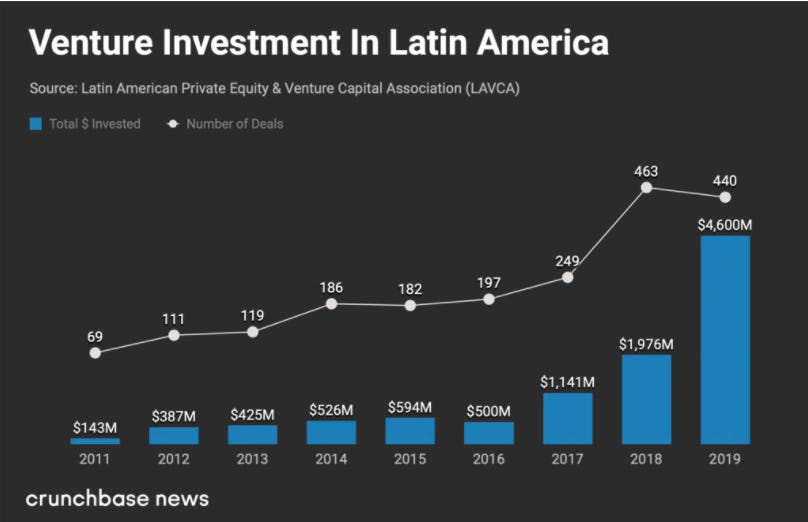

Despite its poor showing as a destination for U.S. VC firms, Latin America more than doubled the amount of venture capital invested between 2018 and 2019, reaching $4.6B. The figure below, from Crunchbase, reveals exponential growth during 2016-2019 after years of relatively flat growth between 2011-2015. Brazilian startups received the lion’s share -- just over 50% -- of the amount invested in 2019, followed by Mexico (22.7%), Chile (9.1%), Colombia (8.2%), and Argentina (6.6%).

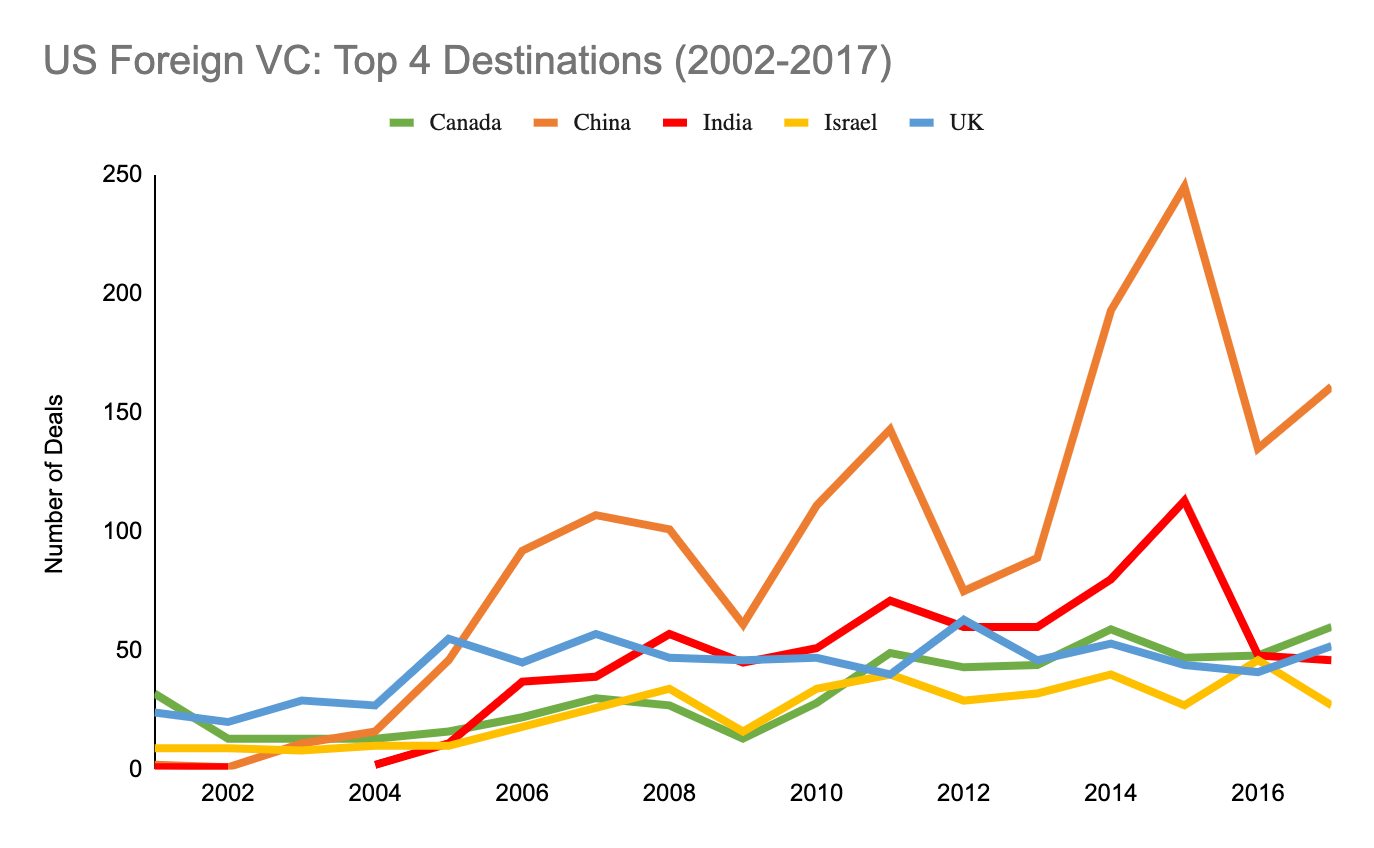

It’s increasing over time. The time trend below shows that the top 100 U.S. VC firms began investing in foreign markets at a reasonably large scale only in the mid 2000’s. The most notable takeoff occurred for China in 2004, with an upward trajectory marked by temporary ups and downs since then. India seems to follow a similar pattern but at a smaller scale, with a notable correlation across the two countries. The significant drop between 2015 and 2016 for those two countries is also stark. The temporal pattern in the remaining three top 5 countries appears to be more idiosyncratic, though activity has increased as a general rule since the early 2000’s.

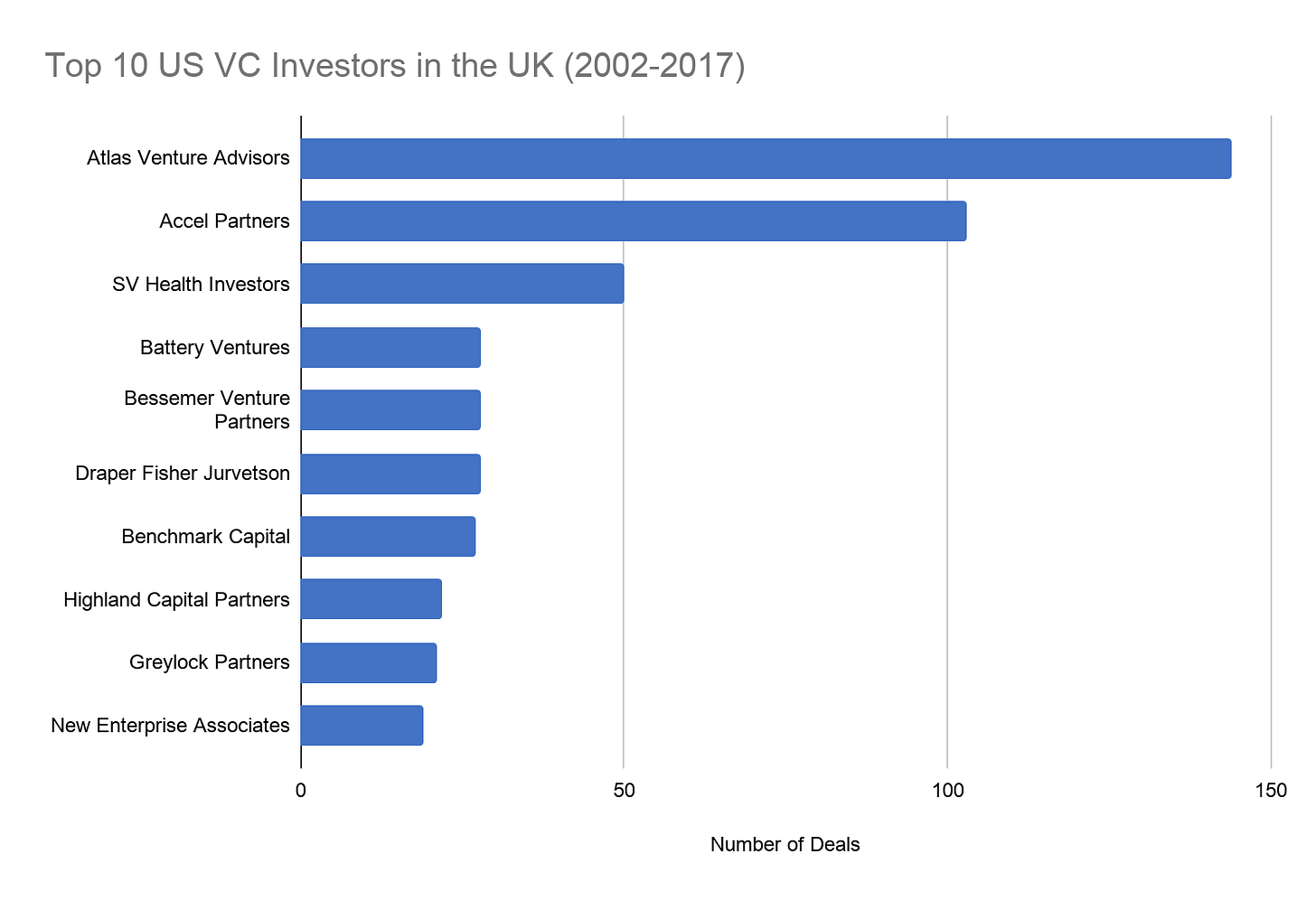

Not all the usual suspects in all the usual places. A critical feature of the pattern of cross-border investments by U.S.-headquartered VC firms is the variation across firms in how much and where they invest abroad. Some, like Sequoia, New Enterprise Associates, and Accel are highly active in international markets. But many other firms otherwise active domestically do not invest much abroad, such as Kleiner Perkins. Further, some firms appear to prefer certain foreign countries over others. The five charts below list the top 10 firms investing in each of the top 5 destinations for U.S. venture capital. What’s most apparent is that the list of top investors across countries is quite different. None of the firms is a top 10 investor in all five major foreign markets, and only New Enterprise Associates appears in four of them (but in the lower rungs of the top 10). Instead, it seems like firms specialize or have a predilection for one or at most two primary markets: Sequoia in China and Israel, Accel in the U.K. and India, Matrix in China and India, Rho Capital in Canada, and Bessemer in Israel. VC firms are not like mature multinational firms with activity across many markets, but more like early internationalizers with interests in one or two critical places.

Help! Why is this happening?

What may be driving differences in the global preferences and investment strategies across VC firms is not apparent from these basic facts. But it remains an open and interesting question. What is clear is that whatever is driving U.S.-based VC firms into foreign markets is not a uniform, industry-wide stimulus. Rather, each firm appears to be motivated by idiosyncratic, strategic reasons that lead to unique decisions about how much and where to invest in foreign markets.

This is where I need your help! I want to study this more deeply in my research and explain the variation I’m seeing in the data. But I haven’t yet formed a coherent hypothesis (or hypotheses) about what may be going on. So if you can spare a minute, please comment at the end of this article with any of your own hypotheses to explain what may be driving different VC firms to vary in how much and where they make cross-border investments in startups. Who knows? I may end up borrowing (stealing?) your idea and publishing something about it!

REFERENCES

Bernstein, S., Giroud, X., & Townsend, R. R. (2016). The impact of venture capital monitoring. The Journal of Finance, 71(4), 1591–1622.

Chen, H., Gompers, P., Kovner, A., & Lerner, J. (2010). Buy local? The geography of venture capital. Journal of Urban Economics, 67(1), 90–102.

Cumming, D., & Dai, N. (2010). Local bias in venture capital investments. Journal of Empirical Finance, 17(3), 362–380.

Gompers, P. A., & Lerner, J. (1999). What drives venture capital fundraising? National bureau of economic research.

Hanemann, T., Rosen, D. H., Gao, C., & Lysenko, A. (2019). Two-Way Street: 2019 Update US-China Investment Trends. Rhodium Group and National Committee on U.S.-China Relations.

Hochberg, Y. V., Ljungqvist, A., & Lu, Y. (2010). Networking as a barrier to entry and the competitive supply of venture capital. The Journal of Finance, 65(3), 829–859.

KPMG. (2020). Venture Pulse Q1 2020: Global Analysis of Venture Funding. KPMG.

Powell, W. W., White, D. R., Koput, K. W., & Owen-Smith, J. (2005). Network Dynamics and Field Evolution: The Growth of Interorganizational Collaboration in the Life Sciences. American Journal of Sociology, 110(4), 1132–1205.

Sorenson, O., & Stuart, T. E. (2001). Syndication Networks and the Spatial Distribution of Venture Capital Investments. American Journal of Sociology, 106(6), 1546–1588.

Sorenson, O., & Stuart, T. E. (2008). Bringing the context back in: Settings and the search for syndicate partners in venture capital investment networks. Administrative Science Quarterly, 53(2), 266–294.

Thanks for sharing the valueable information with us for more click their peakXV

A great article! I am happy to contribute my two cents in the context of Israel:

1. Israel is not considered cross border anymore in the sense that investors know the different army units and groups that can signal success. In addition, most groups that invest in Israel have a Jew/Israeli person on their team or have opened an office here. So basically, they have Build (BBB anyone?) a presence here that helps them to navigate the tacit knowledge.

2. Another reason for cross-border investments is replicating a successful business model. Two good examples I've seen is ArboreVenture that invests in fintech. the BNPL model can be invested in again and again in different geographies. Same with 468 Capital that replicates the Thras.io model for different markets again and again.

3. The sale pitch - VCs are facing increasing competition. It is getting harder to make deals with great companies, and a great company will most likely have many term sheets to choose from. Going international can be a great differentiator - "We can open a new market and help you expand". Israeli VCs that does that - MizMa, UpWest

I am happy to continue brainstorm the model and help :)

Shai Kivity

WG19

Shaikivity@gmail.com